MONTHLY SPOTLIGHT

Brazilian Energy Transition: The Way Forward

Prof. Edmar de Almeida, Institute of Energy in PUC-Rio

Monthly Spotlight

Oct 10, 2023

Brazil is currently a country with one of the highest shares of renewables in the energy matrix. The Brazilian energy transition experience so far deserves attention from energy policy makers from countries trying to develop a decarbonization strategies and policies.

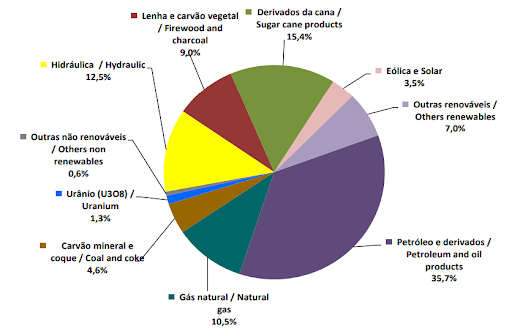

In Brazil, renewable sources already have a share of around 47% of the total energy supply (Figure 1) and around 90% of electricity generation in 2022. In the transport sector, biofuels (ethanol and biodiesel) represented around 21.5% of its total consumption in 2022 (EPE, 2023). In other words, the country has already managed to follow a good path in the process of decarbonizing its energy matrix.

Figure 1 – Domestic Energy Supply in Brazil (2022)

Brazilian Experience in Energy Transition

The path taken by Brazil to date was initially motivated by the low availability of fossil fuel resources until the 2000s, when the country discovered large oil reserves. Brazilian reserves of coal, oil and natural gas were insignificant, and imports of fossil fuels were considered a major obstacle to the country’s economic growth. Policies for promoting the use of renewable resources aimed to reduce the country’s dependence on fuel imports. Technological policy was oriented towards replacing fossil fuels with renewable sources. This enabled Brazil to develop a complex and advanced innovation ecosystem in the energy sector and a supply chain of different renewable energy sources.

Currently, ethanol is sold at a mandatory 27% blend in gasoline and in pure form at all gas stations in the country. Thus, ethanol has already reached a market share of 50% in the otto cycle engine market. In the biodiesel market, Brazil launched a national program for Biodiesel produced from various types of raw materials, despite the dominance of soybean oil, together with the creation of mandatory mixing in mineral diesel sold at gas stations. The mixture started at 2% and gradually grew, reaching 12% of the diesel sold at gas stations today.

Regarding the electricity sector, renewable energy sources represent 86% of the 217 GW generating capacity, with emphasis on hydroelectric generation (109 GW), solar (32 GW) and wind (26.5 GW) and Bioenergy (16.8 GW). In 2022, renewable energy sources were responsible for 92% of the total energy consumed in the country.

This renewable generating park has been developed since the 1970s, which began with a policy to take advantage of the great hydroelectric potential, associated with the development of the integrated transmission system that currently has 183 thousand kilometers of transmission lines. Between the 1970s and 2010, the country built one of the largest integrated electrical systems in the world, with large hydraulic reservoirs, with a storage capacity equivalent to 4 months of consumption today. The integrated electrical system with storage capacity represents a facilitator for the integration of variable renewable sources from 2010 onwards.

It is also worth highlighting the strong advance in distributed solar generation, with the implementation of the net-metering system. The installed capacity in distributed generation in the country jumped from 0.4 GW in 2018 to 23 GW in July 2023.

Opportunities and challenges ahead

One of the most important technological trajectories in the energy transition process taking place around the world is the electrification of the economy. Different scenarios for the energy transition point to an increase in the share of electrical energy in the global energy supply from 20% to levels between 50% and 60% in 2050 (Irena, 2021).

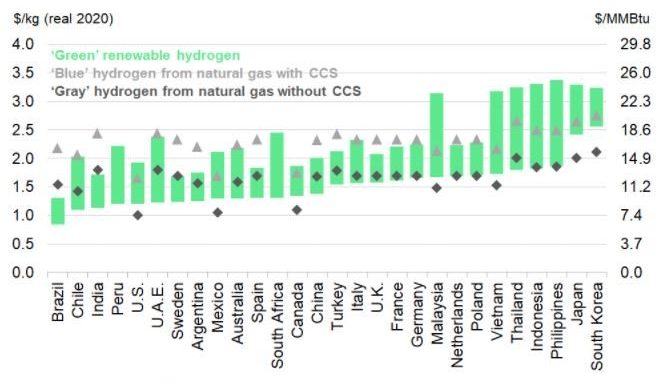

Brazil has great potential to become a hub for attracting industrial investments in the context of the energy transition that is unfolding. Firstly, the country already has a decarbonized and diversified electricity matrix in terms of sources. Renewable generation sources have become arguably the most competitive for the expansion of the national electricity sector, which puts the country in a position of great competitive advantage for the production of green hydrogen. Bloomberg (2022) identified Brazil as the country with the potential to produce green hydrogen at the lowest levelized cost in the world in 2030 (Figure 2).

Figure 2 – Estimated Hydrogen Levelized Cost in 2030

The large volume of quality energy resources gives Brazil a green generation potential that is much higher than the growth in demand for electricity in the coming decades (EPE, 2020). This potential allows Brazil to not only decarbonize its economy, but also export renewable energy, in the form of green hydrogen (through its carriers such as ammonia or methanol) or in the form of energy-intensive products such as steel, aluminum, urea and other products where hydrogen can competitively replace fossils as an industrial input.

However, to jump ahead in the green reindustrialization race it will be necessary to reform the current electricity sector, to allow for this new investment cycle. Several economic and regulatory issues will have to be addressed. Table 1 presents the main opportunities challenges for the country and short, medium and long-term.

Table 1 – Main challenges and opportunities for the energy transition via green electrification in Brazil

| OPPORTUNITIES | CHALLENGES |

|---|---|

| SHORT-TERM | |

| Increasing electricity demand to take advantage of current excess production capacity in the power sector | Restructure the current electricity pricing system to accelerate the desired transition with expansion of renewable generation associated with the electrification process; |

| Promotion of the diffusion of electric vehicles (plug-in hybrids and pure) | Review of system operating rules to improve operational safety. |

| Dissemination of scalable pilot projects for distributed hydrogen production in industry using grid energy | Incentives for energy transition based on the creation of a regulated carbon market, blended finance platforms and temporary and focused tax incentives |

| Incentive and certification policies for decentralized production of green hydrogen from grid energy | |

| Reforms to improve distributors' investment capacity in smart grids and electric vehicle supply systems | |

| Reduction of charges in the electricity sector | |

| Reduction of non-technical losses in the electrical sector | |

| Creation of an efficient regulatory framework for offshore wind generation concessions | |

| MEDIUM-TERM | |

| Partial decarbonization of industrial sectors through the electrification of heat demand at low temperatures, through an industrial electrothermal program | Incentive policy for industrial investments aimed at producing decarbonized energy-intensive products |

| Development of green hydrogen hubs for exporting electrical energy via carriers such as ammonia and methanol | Incentive policy for the electrification of logistics company fleets |

| Attraction of decarbonized energy-intensive industrial enterprises (Reshoring) | Creation of financing lines for innovative industrial decarbonization projects |

| Creation of a policy for offshore wind farms associated with hydrogen hubs and their use in large-scale projects aimed at export | Prepare the national transmission system to respond quickly to the expansion of renewable generation associated with the electrification process of the economy |

| LONG-TERM | |

| Decarbonization of “hard to slaughter” sectors through the scaled production of synthetic fuels through green hydrogen | Support for research for the development of new technologies that allow expanding the electrification of industry and the dissemination of technologies for decarbonization of the air, maritime and cargo transport sector |

| Development of a decarbonized hydrogen transport infrastructure | |

Given the opportunities and challenges above, it is essential to identify a future vision for the energy sector and a structured energy policy agenda for the transition to a low-carbon economy in Brazil. This agenda will reflect the country specific energy resource endowment and institutional capacity. Nevertheless, it is worth highlighting that there is great space for collaboration between Brazil and other developing countries with lower levels of renewable resources. International collaboration on R&D, policies and market design and renewable energy trade can be an important vector of development for Brazil and for the acceleration of the transition in large fossil energy consuming countries such as India and China.

References:

BLOOMBERG-NEF (2020). Green Hydrogen to Outcompete ‘Blue’ Everywhere by 2030. Available at: https://about.bnef.com/blog/green-hydrogen-to-outcompete-blue-everywhere-by-2030/

EPE (2020). Plano Nacional de Energia 2050. Available at: https://www.epe.gov.br/pt/publicacoes-dados-abertos/publicacoes/Plano-Nacional-de-Energia-2050

EPE (2023). Balanço Energético Nacional. Available at: https://www.epe.gov.br

IEA (2022). World Energy Outlook 2022. Available at: https://www.iea.org

IRENA (2021). World Energy Transitions Outlook: 1.5°C Pathway. Available at: https://irena.org/publications/2022/mar/world-energy-transitions-outlook-2022

Mckinsey (2022). Climate risk and the opportunity for real estate. Available at: https://www.mckinsey.com/industries/real-estate/our-insights/climate-risk-and-the-opportunity-for-real-estate