Carbon Border Adjustment Mechanism (CBAM) – the Why, What and How?

May 2023 saw the regulation of the Council of the European Union (EU) and European Parliament implementing the Carbon Border Adjustment Mechanism (CBAM) coming into force, and since there has been a lot of buzz around CBAM globally. So, let us understand by means of 3 questions what this terminology and concept is all about.

Why CBAM?

With the European Union embarking on its journey towards carbon neutrality by 2050 multiple tools have been released to assist the EU to achieve its ambitious climate targets. One such tool under the ‘Fit for 55’ package (i), is the EU Emission Trading System (ETS) (ii) to promote attaining a 55% greenhouse gas (GHG) emission reduction target by 2030. However, the EU ETS might place the companies covered by it at a competitive disadvantage in international trade compared to companies in jurisdictions without carbon pricing. This in turn can lead to “carbon leakage” which means incentivizing EU companies to relocate their production to regions with less stringent climate policies, thus diluting the environmental efforts made by the EU. In order to prevent carbon leakage and instead encourage cleaner industrial production in non-EU countries, the CBAM has been brought in place.

What is CBAM?

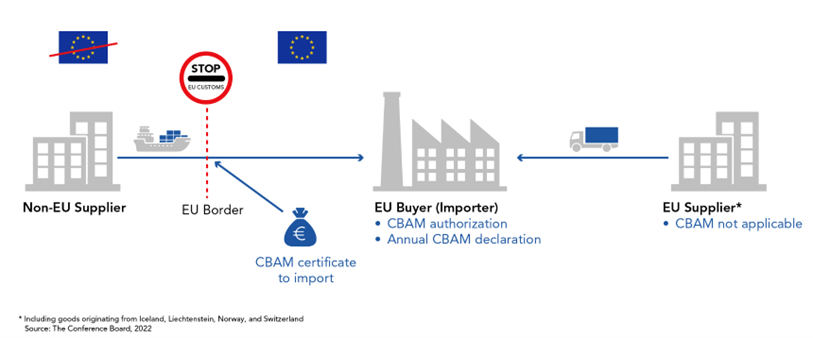

To put it simply, CBAM is a tariff on carbon-intensive goods imported from abroad. It is a regulatory tool to put a fair price on the carbon emitted during the production of carbon intensive goods that are entering the EU. Under this mechanism, EU importers will need to buy carbon certificates corresponding to the embedded emissions in their products unless the exporting jurisdiction has an equivalent carbon pricing system in place. The cost of certificates depends on the carbon price in the EU ETS and any difference with the carbon price paid in the exporting jurisdiction.

CBAM will therefore ensure that the carbon price of imports is equivalent to the carbon price of domestic production by confirming that a price has been paid for the embedded carbon emissions generated in the production of certain goods imported into the EU, and that the EU’s climate objectives are not undermined. The CBAM has been designed to be compatible with World Trade Organization (WTO) rules.

How will it work?

The CBAM system will mirror the EU ETS, it will be applied on the actual declared carbon content embedded in the goods imported in the EU, according to a formula that will reflect the effects of the EU ETS on the production of similar goods in the EU. Over a period of eight years, CBAM is supposed to gradually replace the free allowances given under the EU ETS.

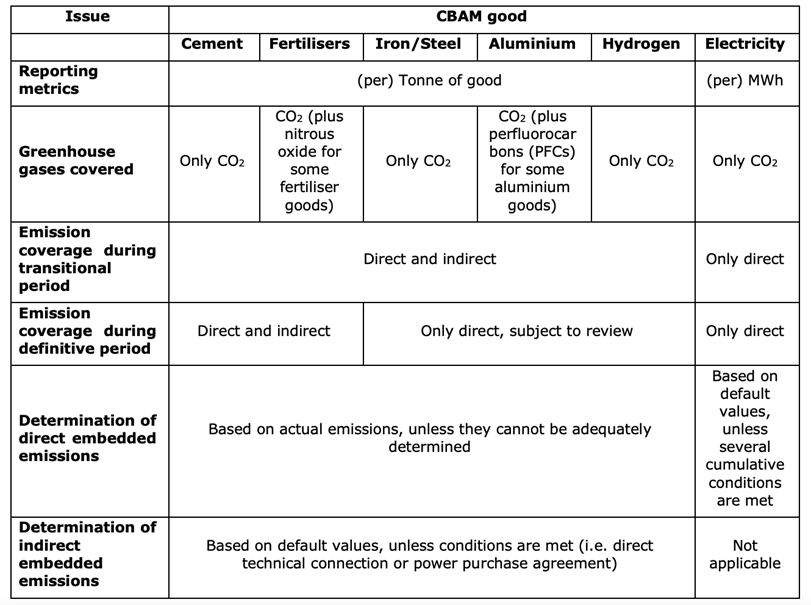

Transitional Phase: CBAM entered into application in its transitional phase on 1 October 2023, finishing at the end of 2025. It will initially apply to imports of certain goods and selected precursors whose production is carbon intensive and at most significant risk of carbon leakage. These include the following 5 goods: cement, iron and steel, aluminium, fertilizers, electricity and hydrogen. The CBAM will apply to direct emissions of greenhouse gases emitted during the production process of the products covered, as well as to indirect emissions for a subset of those products (i.e., cement and fertilizers).

The CBAM Regulation provides that an analysis will need to be carried out before including indirect emissions in further products in the future. Thus, a review of the CBAM’s overall functioning during its transitional period will be concluded before the definitive system kicks in. The European Commission will then develop secondary legislation before the end of the transitional period to design the rules and processes to take in to account the effective carbon price paid abroad. Meanwhile the transitional period reports will be required to include the carbon price due in a country of origin for the embedded emissions in the imported goods, accounting for any rebate or other form of compensation available, for information purposes. This quarterly CBAM report is submitted by the importer using the CBAM Transitional Registry which will be deployed for the use of Economic Operators in the EU as from the 1st of October 2023 together with a set of webinars and trainings which will facilitate the use of the registry and the submission of data during the transitional period.

Figure 1: Overview of the specific emissions and GHGs covered and how direct and indirect emissions will be determined for each sector under the CBAM scope [1]

The objective of this transition period is to serve as a pilot and learning period for all stakeholders (importers, producers and authorities) and to collect useful information on embedded emissions to refine the methodology for the definitive period. Also, the gradual phasing in of CBAM will allow for a careful, proportionate and predictable transition for EU and non-EU businesses, as well as for public authorities. During this period, importers of goods in the scope of the new rules will only be reporting greenhouse gas emissions embedded in their imports (direct and indirect emissions). Therefore, to facilitate a smooth roll-out, no financial adjustment will have to be made by EU importers during this time.

Full implementation: CBAM will eventually (once fully phased in) capture more than 50% of the emissions in ETS covered sectors. During the first year of implementation, companies will have the choice of reporting in three ways:

(a) full reporting according to the new methodology (EU method);

(b) reporting based on equivalent third country national systems; and

(c) reporting based on reference values. As of 1 January 2025, only the EU method will be accepted.

From 1 January 2026, the EU importers of goods covered by the CBAM will need to buy CBAM certificates. The price of the certificates will be calculated depending on the weekly average auction price of EU ETS allowances expressed in €/tonne of CO2 emitted. By 31 May each year, the EU importer must declare the quantity of goods and the embedded emissions in those imported goods into the EU in the preceding year. At the same time, the importer surrenders the number of CBAM certificates that corresponds to the amount of greenhouse gas emissions embedded in the products. If importers can prove, based on verified information from third country producers, that a carbon price has already been paid during the production of the imported goods, the corresponding amount can be deducted from their final bill.

Figure 2: EU CBAM Illustration [2]

We find that CBAM is being touted as a pioneering policy that aligns international trade rules with climate policy. Given that combating climate change needs collective efforts, CBAM is to serve as an innovative instrument for the EU to address carbon leakage, foster fair competition, and stimulate global climate ambition. However successful execution of CBAM necessitates a balance between fairness and feasibility along with proactive international cooperation.

#CBAM #CarbonPricing #CarbonLeakage, #EmissionsTrading #WorldTrade #EU

Notes:

[1] European Commission, “EUROPEAN COMMISSION MEMO Questions and Answers: Carbon Border Adjustment Mechanism (CBAM)”.

[2] The Conference Board, “EU Carbon Border Adjustment Mechanism: A Primer for Stakeholders.” Accessed: Oct. 12, 2023. [Online]. Available: https://www.conference-board.org/topics/climate-change/EU-carbon-border-adjustment-mechanism-primer-for-stakeholders

(i) The Fit for 55 package is a set of proposals to revise and update EU legislation and to put in place new initiatives with the aim of ensuring that EU policies are into line with the climate goals agreed by the Council and the European Parliament.

(ii) The EU’s Emissions Trading System (ETS) is the world’s first international emissions trading scheme and the EU’s flagship policy to combat climate change. It sets a cap on the amount of greenhouse gas emissions that can be released from power production and large industrial installations. Allowances must be bought on the ETS trading market, though a certain number of free allowances is distributed to industry to prevent carbon leakage.

Read more: https://climate.ec.europa.eu/eu-action/eu-emissions-trading-system-eu-ets_en