Power exchanges is a term that is frequently used in reference to the power and electricity industry. Even though some of us may know what these exchanges generally entail, let’s break down how they operate and why they are necessary.

What is a power exchange?

Power exchanges (PXs) are defined as platforms where electricity can be traded i.e., it facilitates the buying and selling of electricity. Entities like electricity producers, utilities and other electricity suppliers use the power exchange to submit price and quantity bids to sell their production and cover their estimated demand respectively.

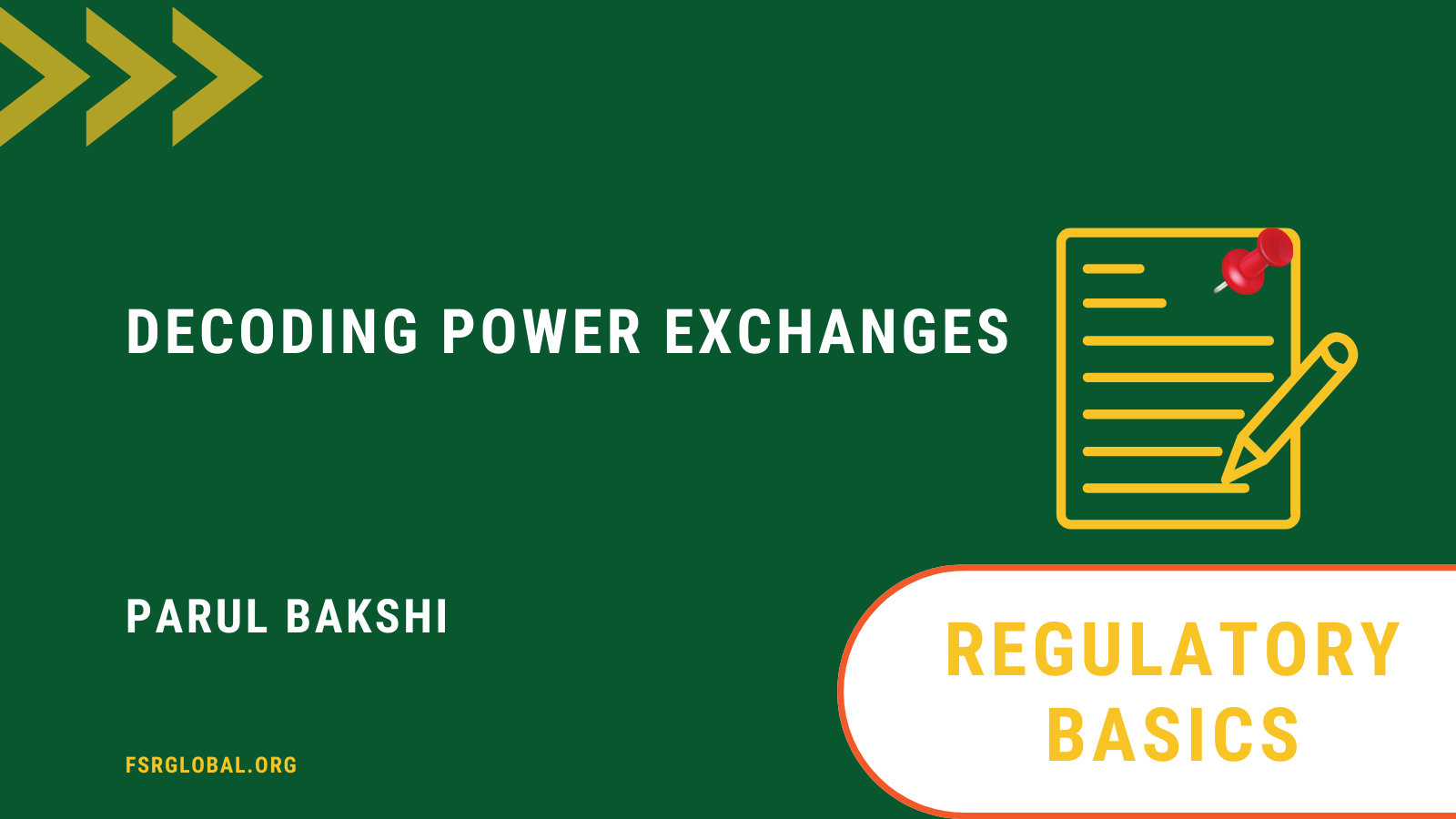

Power exchanges are part of the wholesale market for electricity such as day-ahead and hour-ahead markets. The wholesale market begins with electricity generators which is bought by an entity that will often, in turn, resell that power to meet end-user demand. In some cases, utilities may also own generation and sell directly to end-use customers. Long term method of power trading can be conducted in the wholesale market over varying time periods — small (up to 1 year), medium (1–5 years), and long term (5–25 years). While short-term market trade usually refers to a contract for a period of less than one year. The figure below showcases the different electricity market trading windows.

Fig 1: Electricity Market Trading Windows [1]

Why do we need power exchanges?

The ideology behind the development of power exchange was for it to act as a facility for smooth and near real-time trading of electricity. Trading through an exchange enables the traders to discover the best price in the market based on current market conditions, and to find the optimum buyer or seller for trade. Also, as a result, the generation companies greatly benefit from the timely payments and there is efficient management of buyers’ power portfolios. Further, it is deemed that more options and freedom to market participants can stimulate competition in power trading, leading to lower power prices, enhanced system efficiency and incentives to innovation. Power exchange introduces transparency in the market clearing and reduces counter-party credit risk. The power exchange, hence, manages trades, clears market, and settles financial transactions.

How does a power exchange work?

The power exchanges primarily offer a trading platform to their exchange members. These members can then connect to this platform and submit their orders for buying and/or selling power, which are registered in an order book. These orders reflect the demand and supply for a specific electricity market area at a given moment in time.

Based on this order book, the power exchanges calculate a market price for the trading to take place at, which are legally binding agreements to sell or purchase a specific quantity of electricity to a defined delivery area for the matched (or “cleared”) price. For every delivery period, a single price known as the market clearing price (MCP) is established that is applicable to both buyers and sellers. This MCP never goes below the seller’s proposed sale price or above the buyer’s agreed-upon buying price.

Market participants trade constantly (24 hours a day) with same-day delivery on the intraday market. When the purchase and sell orders line up, the trade is carried out. Electricity can be traded up to 5 minutes before delivery (varies across power exchanges) and through hourly, half-hourly or quarter hourly contracts. Members use the Intraday market to make last-minute adjustments and to balance their positions closer to real time as it allows for a high level of flexibility.

The transaction is cleared and settled once trading on a power exchange platform is finished. Through clearing, every deal that has been finalized or registered on the exchange is guaranteed to be fulfilled correctly. After a deal is completed, the clearing house(i) assumes the role of central counterparty and becomes the buyer and seller’s contractual partner. By doing this, the clearing house reduces the counterparty risk and guarantees the fulfilment of each trade (payment and delivery).

Operational constraints and environmental variables constantly limit the flow on transmission lines. Transmission link instability can result from imbalances; thus, constant supply and demand balancing is necessary for electrical networks. In order to obtain technical approval for power transactions via the grid, the exchange in the electricity market is synchronized with the System Operator (SO). Nonetheless, the supply and demand, liquidity, economy, and other factors of the market all affect the design and operation of a power exchange or power market in general.

Power Exchange Regulatory Landscape in India

India, as of November 2023 has 3 functioning power exchanges – Indian Electricity Exchange (IEX, 2008), Power Exchange of India (PXIL, 2008) and Hindustan Power Exchange (HPX, 2022). According to Section 66 (178) of the Indian Electricity Act 2003, the development of a market for electricity is responsibility of the regulators. As a result, in 2006, the Central Electricity Regulatory Commission (CERC) discussed “Developing a common platform for electricity trading” through a staff paper following which guidelines for grant of permission for setting up and operation of power exchange were released in 2007.

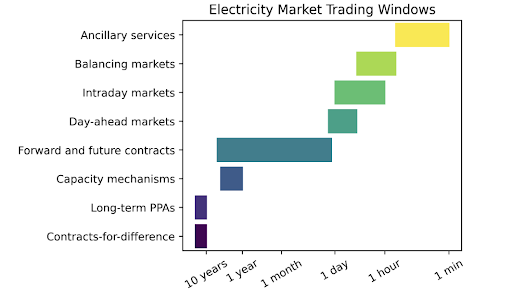

In 2008, both IEX and PXIL commenced their operations with the day-ahead market (DAM) for buying and selling electricity on a day-ahead horizon, with double-sided closed bidding auction(ii) for price discovery. Further to govern transactions involving power trading, Power Market Regulations (PMR) were issued by CERC in 2010 which have been updated and replaced by PMR 2021. The figure below highlights all the key participants within the power exchange landscape of India.

Fig 2: Key Participants in Power Exchange Landscape of India, Source: Author using [2]

The potential of power exchanges to drive price discovery and balance supply and demand is becoming increasingly important as India’s demand for electricity rises. To stay up with the changing Indian power industry, the exchanges must, nevertheless, continuously prioritize innovation in order to introduce new products and segments. In the figure below we see the different products which are presently available in the Indian power market (specifically available on IEX).

| Day-Ahead Market | • Delivery for next day • Price discovery: Closed, Double-sided Auction |

| Intraday Market & Day-Ahead Contingency | • Intraday: For Delivery within the same day • Day Ahead Contingency: Another window for next day • Gate closure: 3.5 hours |

| Term-Ahead Contracts | • For delivery up to 11 days • Daily Contracts, Weekly Contracts |

| Renewable Energy Certificates | • Green Attributes as Certificates • Sellers: RE generators not under feed in tariffs • Buyers: Obligated entities; 1MWh equivalent to 1 REC |

| Energy Saving Certificates | •1 Escert = 1 Mtoe (Metric Tonne Oil Equivalent) • Trading Session on every Tuesday of the Week • Trading time 1300 hrs to 1500 hrs |

| Real-Time Market | • Delivery within an hour • Price discovery: Closed, Double-sided Auction |

| Green Term Ahead Market | • Intraday, Day Ahead Contingency, Daily and Weekly |

Table 1: Products available on Indian Power Exchanges, Source: Author adapted from [2]

By enabling efficient transactions and price discovery, the exchange gains traction as electricity use rises, contributing to a more robust and dynamic energy market ecosystem. Power exchanges have been instrumental in lowering the cost of integrating renewable energy sources and offering effective price signals for the addition of newer capacity on a global scale. Taking this into consideration, the government wants to raise the percentage of power exchanges market share to 25% by 2030 [3].

With the growing share of renewables in national energy mix across the globe, short term power trading will need to adapt to the specific characteristics of renewables whilst minimizing price impacts. It is well understood though that the need and role of power exchanges is only growing and there are now power energy exchanges which include exchange of gas and not just electricity. There are also various measures under consideration among electricity sector stakeholders which look into further enhancing and regulating the role of power exchanges.

#PowerExchanges#Electricitytrading#Electricitymarkets #PowerMarketRegulations

References:

[1] G. Zachmann, L. Hirth, C. Heussaff, I. Schlecht, J. Mühlenpfordt, and A. Eicke, “The design of the European electricity market Current proposals and ways ahead,” Policy Department for Economic, Scientific and Quality of Life Policies Directorate-General for Internal Policies, 2023, Accessed: Nov. 18, 2023. [Online]. Available: https://www.europarl.europa.eu/RegData/etudes/STUD/2023/740094/IPOL_STU(2023)740094_EN.pdf

[2] IEX, “FUNCTIONING OF POWER EXCHANGES,” India Energy Exchange, 2018.

[3] Mohammad Danish, “How is power exchange transforming the energy sector?” Accessed: Nov. 18, 2023. [Online]. Available: https://www.tpci.in/indiabusinesstrade/blogs/how-are-power exchanges-transforming-indias-energy-sector/

[4] Y. K. Bichpuriya and S. A. Soman, “Electric Power Exchanges: A Review,” 2010.

(i) A clearing house acts as a mediator between any two entities or parties that are engaged in a financial transaction. Its main role is to ensure that the transaction goes smoothly, with the buyer receiving the tradable goods he intends to acquire and the seller receiving the right amount paid for the tradable goods he is selling.

(ii) In double sided auction scheme, both power suppliers and consumers are allowed to submit volume-price offers and bids respectively. In close or sealed auction, bids or offers are not opened to the market participants [4].