Opinion

Maximizing the value of public support to infrastructure investment for energy transitions

This article aims at analysing the objectives and tools available to facilitate investment in low-carbon energy infrastructure.

1. The General Framework

From a broad standpoint, we may consider that the coordination of energy systems is characterized by two intertwined fundamental dimensions:

- The first one deals with the challenge of short-term coordination. Short term refers to a time scope where no new assets can be added to the system. In this context, operational cost allocation is the main challenge. Oftentimes, most policy decisions implying market players’ choices over time are disregarded.

- The second dimension focuses on decisions over time, where the main concern is inter-temporal efficiency, and the main challenge is risk allocation. The question at centre stage is the investment decision.

Early market designs dealt with the first dimension in greater detail (spot pricing of electricity), and implicitly considered the second dimension as a given consequence of spot pricing (“once defined the spot price, forward markets will arise”).

In this article, we consider the second dimension (inter-temporal decisions) in greater detail: the financial dimension. The first characteristic that needs consideration in energy markets is that the assets implied require significant upfront capital to be built. From the risk point of view, this means that, during construction, the project faces very large costs expecting their recoup in the future. Because investments are typically long-lived, recoup happens over many years.

This means that, considering only one project, the supply of capital (e.g. a commercial bank) will require the demand of capital (i.e. the project) to have an “acceptable” risk of not obtaining income in the future. Many of the elements of the financial question are related to the definition of “acceptable”.

Likely, the most discussed requirement in energy markets is the need for a certain acceptable promise of future income on the side of the project (demand of capital). This comes normally from some form of off-take agreement (a commitment that the project will be used and paid for). Various forms of long-term contracting help to these aspects, regardless they are purely market-based, defined by market design, or some hybrid solution. This may be understood as analysing in more detail the previous dimension tagged by “forward markets will arise”.

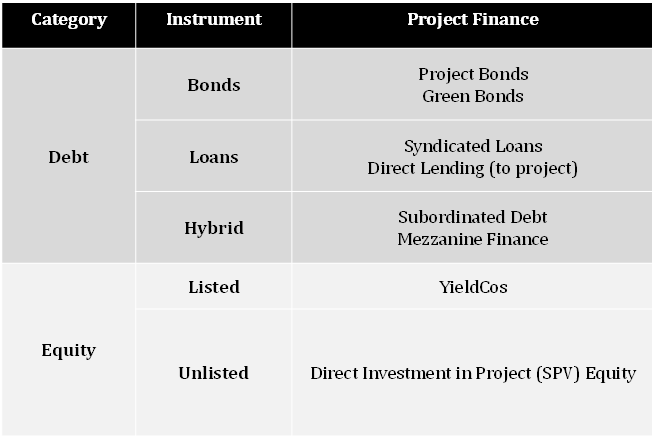

Figure 1. Financial vehicles to structure large projects. Source: (Vazquez et al., 2018) and (OECD, 2015).

One typical situation found when dealing with long-term investment in infrastructure is that these vehicles are not liquidly traded in the market. Consequently, structuring large infrastructure projects tends to be a complex task.

2. Energy transitions investment in EMDCs

The previous challenges are exacerbated in Emerging and Developing Countries (EMDCs), largely because markets tend to be comparatively less liquid. Hence, the flows of capital from sources abroad face difficulties in reaching the projects. This results in higher costs of capital, which may make the projects infeasible.

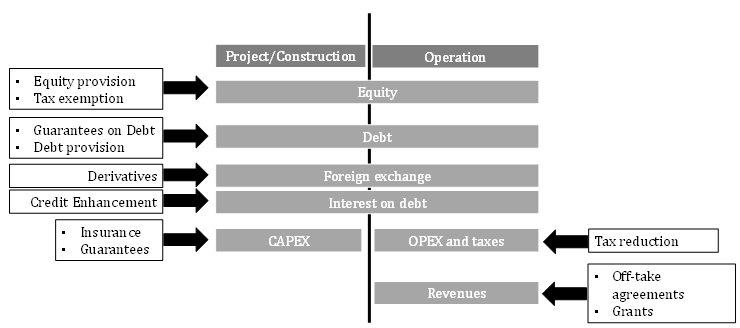

The following analysis aims to give an overview of the main elements behind the design of public financial support for investment. To facilitate the analysis, let us simplify the representation of the financial structure of a single energy generation project as in Figure 2.

Figure 2. Tools to de-risk large projects. Source: (Vazquez et al., 2018).

The first alternative that is usually considered targets enhancing the revenue stream of the project. To that end, it is possible to consider grants to reduce capital needs. This solution, despite being quite direct, is limited by tight budget constraints.

A risk frequently faced by infrastructure projects, which constitutes a significant barrier to obtain financial close, is the off-take risk. Guaranteeing the possibility of a long-term offtake agreement (for instance, through contracting obligations on the demand side) allows obtaining a reasonable commitment. Besides, it constitutes a tool to implement subsidies program, which helps allocating public funds to a larger set of projects.

Complementing support aimed at income streams, optimization of financial aid may be needed to facilitate access to capital sources. The most efficient tools to do that depend on the kind of investment involved, and therefore, on the physical configuration of the undertaking. The idea is to make to the market a menu of financial tools that help structure a project pipeline as wide as possible.

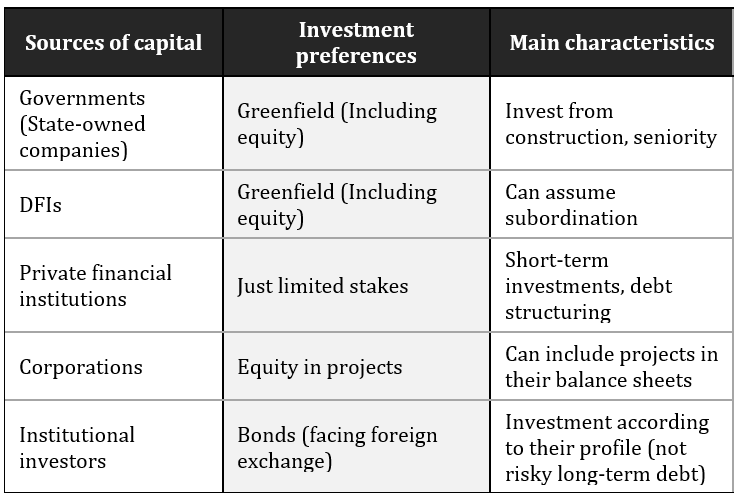

Table 2 describes stylized profiles that aim to serve as a guide of different investment objectives. State-owned companies are traditionally relevant for infrastructure investment, as they are relatively willing to bear risk at the construction phase. In that context, their actions to implement public policies are often characterized by the development of infrastructure. They typically use equity and senior bonds. Another important player for infrastructure investment are development banks and financial institutions (including MDBs). As state-owned companies, they can invest at the construction phase as well as providing de-risking instruments (guarantees, financial insurance). Particularly, they can assume subordination (e.g. mezzanine finance).

Another important source of finance for infrastructure is energy corporations. By having strong short-term positions in the energy market using the infrastructure, they add projects to their balance sheet. Over the last years, oil and gas companies have increased their participation in this kind of investment.

Institutional investors (sovereign funds, insurance and pension funds) are not usually interested in high exposures (equity) but long-term (senior) debt tends to match adequately their risk profiles. Commercial banks are normally interested in short-term instruments, but they can play an important role in structuring debt.

Table 1. Sources of capital according to their preferred risk profiles.

Hence, the supply of capital is made up of a heterogeneous pool of suppliers, with different risk aversion (hence, different definition of what is “acceptable” risk). To optimize access to the pool of capital sources, public funds may be used to introduce de-risking instruments (as the ones represented in Figure 2) to make the investment opportunity more attractive for different kinds of capital sources.

3. Financing infrastructure in small islands

Small island states are often characterized by a strong reliance on expensive imported fossil fuel. Typically, they are also vulnerable to the effects of climate change. We may identify two fundamental contexts for island states. On the one hand, the ones that are electrified, which rely heavily on imported fossil fuels. Many of them have undertaken the transition to renewable energy. Hence, the typical path requires integrating renewables to substitute existing plants based on imported fossil fuel. This may impact the design of transitional arrangements, as transitions will potentially affect their balance of payments.

Besides, several island states have regions with low access to electricity. In these cases, the transition involves more the electrification of population without access. In this context, the choice is to get access through imported fossil fuels or scale up decentralized renewable energy solutions (which in turn can develop other socio-economic benefits, local economic stability, gender equity)

Furthermore, dealing with disaster risks drives a large part of decision-making processes. This, in turn, introduces the possibility of obtaining funds for the energy transition if the associated infrastructure improves disaster risk response. Therefore, availability of funding will be closely related to the recommendations of a document fulfilling the functions of a resilience plan.

As a general conclusion, we may question whether more financial design is needed, or it is only a matter of more funding. The precise amount of capital required for investments related to energy transitions may varying on the parameters for the calculation. The aim of this article is to stress the fact that such amount can be de-risked regardless the assumptions. The need for de-risking is not new for most stakeholders (lenders, countries, etc.), and more efficient support to facilitate investments is often pointed at as a limitation to maximize the value of public finance. From this point of view, deepening the discussion on the role for credit enhancement measures at the international level will be welcome. Stressing the complementary roles played by financial hedges and guarantees dealing with credit risk may be an interesting way forward in the discussion of financial aspects of energy transitions.